The Price-to-Rent Ratio: Should You Rent or Buy in Boston?

A ratio to make smarter financial decisions about renting or buying (in Boston’s competitive housing market)

Deciding whether to rent or buy a home is one of the most significant financial decisions many of us will face. One simple but effective tool to help guide this decision is the price-to-rent ratio. It’s a straightforward metric that compares the cost of purchasing a home to the cost of renting, helping you determine which makes more financial sense.

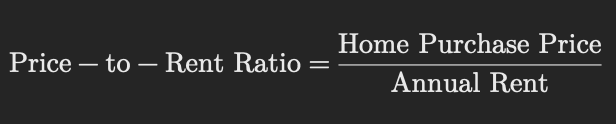

What Is the Price-to-Rent Ratio?

The price-to-rent ratio is calculated as:

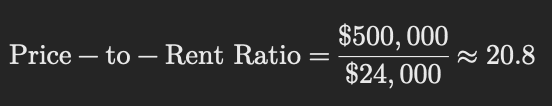

For example, if the home you’re considering costs $500,000 and the annual rent for a comparable property is $24,000:

This ratio provides a quick snapshot of whether buying or renting makes more sense based on market conditions.

How to Interpret the Price-to-Rent Ratio

Here’s a general rule of thumb for interpreting the price-to-rent ratio:

• Less than 15: Buying is typically more favorable. Home prices are relatively low compared to rents, making ownership a better financial decision.

• Between 15 and 20: It depends on other factors like taxes, maintenance, and your long-term plans. This middle range calls for a deeper analysis.

• Above 20: Renting is generally more cost-effective. High ratios indicate that home prices are high relative to rents, making renting the smarter choice.

Applying the Price-to-Rent Ratio in Boston

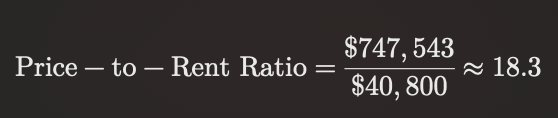

To understand how this metric plays out in Boston, let’s use current market data:

• Average Rent: As of December 2024, the median rent in Boston is approximately $3,400 per month, equating to $40,800 annually. (Zillow)

• Average Home Price: The average home value in Boston is around $747,543. (Zillow)

Using these figures:

A ratio of 18.3 places Boston in the middle range. Whether renting or buying makes more sense depends on additional factors like maintenance costs, property taxes, and your long-term plans.

What Does Owning Include?

The cost of homeownership goes beyond the home price. When considering the “price” part of the ratio, factor in:

• Property Taxes: Often 1–2% of the home’s value annually. (Business Insider)

• Insurance: Homeowner’s insurance adds another cost, usually $1,000–$2,000 annually. (Forbes)

• Maintenance: A common estimate is 1% of the home’s value per year.

• Mortgage Insurance: For low down payment loans like FHA, you’ll pay an additional premium.

• Opportunity Cost: Tying up a significant down payment means you lose potential returns from investing that money elsewhere.

Opportunity Cost is a huge factor to pay attention to. Traditional down payments often require 20% of the cost of the home and closing costs eat up even more capital which all could have been in the market compounding.

The Nuances of Renting

Renting may seem more straightforward, but it also comes with considerations:

• Flexibility: Renting offers mobility. If you’re unsure where you’ll be in 3–5 years, renting might make more sense.

• Lack of Equity Building: Unlike owning, rent payments don’t build equity in an asset.

• Market Sensitivity: Rent prices can fluctuate, especially in high-demand areas, making it harder to budget long-term.

Real-World Considerations

While the price-to-rent ratio is a helpful starting point, it doesn’t account for:

• Appreciation or Depreciation: Owning property in a growing market can lead to equity gains while renting misses out on this potential upside.

• Tax Benefits: Homeownership offers deductions like mortgage interest and property taxes, which can offset costs.

• Lifestyle Factors: The intangibles—like pride of ownership or the ability to customize your space—can outweigh pure financial logic for some people.

At the end of the day, money should not just be about money but it should get you somewhere you want to be. And if where you want to be is owning a home, then that's perfectly fine. Just try not to overpay for that goal.

My Take on the Price-to-Rent Ratio

In dense urban areas like Boston, the price-to-rent ratio often skews higher, making renting more attractive. This suggests renting may be the better option unless you have a long-term plan to stay in the home or can leverage low-down-payment loans to make ownership more accessible.

I've historically leaned toward renting as I intend to stay in high-density cities for the foreseeable future, especially when I factor in the opportunity cost of locking up capital in a down payment. That said, the idea of leveraging a low-down-payment loan to buy a multifamily property (and offset costs with rental income) is intriguing and something I’m exploring.

The price-to-rent ratio isn’t the only factor to consider, but it’s a great first step to evaluating your options.

Run the numbers, weigh the pros and cons, and make the choice that aligns with your financial goals and lifestyle. As always, personal finance is just that—personal.