Time Value of Money

A powerful concept to understand the importance of investing, cash today, and how inflation quietly erodes our potential wealth.

$1 today is worth more than $1 in the future. Why?

It comes down to the earning potential of money.

The core concept here is that it's always more valuable to have cash on hand now than to get the same amount at some future point.

Let's take a simple scenario using saving account interest rates.

Currently, traditional bank savings accounts pay 0.06% annually in interest, while high-yield savings accounts net roughly 10x that at 0.5%.

While most banks use compound interest, we'll use simple interest to demonstrate. This means that $1,000 would net a paltry $0.60 in a traditional account and about $5 in a high-yield savings account in a year.

Definitely not life-changing, but better than nothing.

There are other ways to put our money to work more effectively though.

Here's an example that's a little more exciting: the stock market.

Stock market returns since inception (1871) till now returned about 9-11% annually. Using the lower end of a 9%, that $1,000 we were talking about becomes $1,090 after a year, which is a whole lot better than getting that same $1,000 a year from now.

Even better, that extra $90 will keep compounding as long as it stays invested year after year.

Keep in mind though that this is just an example.

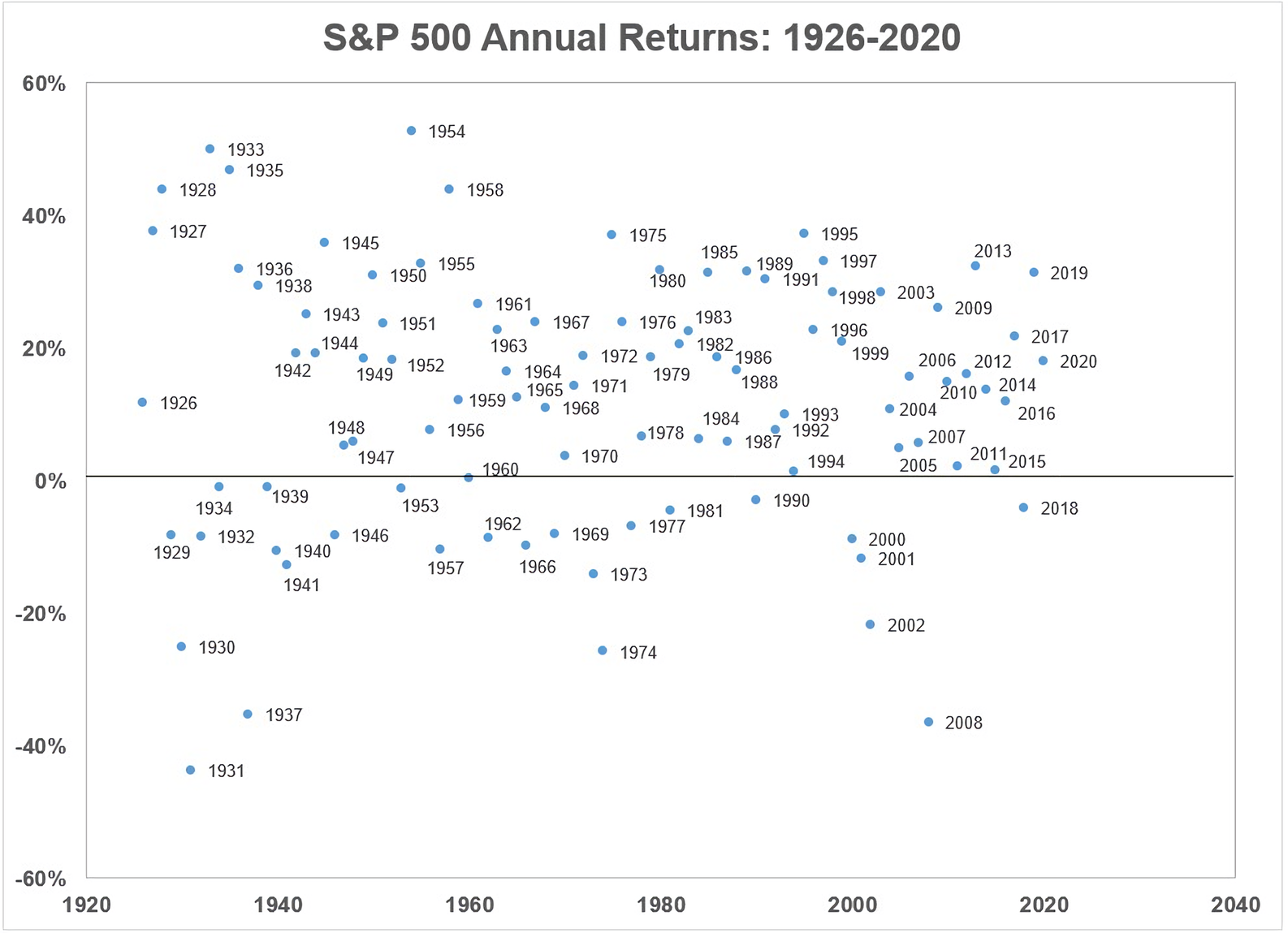

On average, the stock market doesn't return a guaranteed consistent 9-11% return otherwise it would be a no-brainer to invest in it.

It has and will on occasion return both sharp losses (-20%) and sharp gains (+20%) and can be incredibly volatile as shown in the bear market of March 2020 and the rebound afterward.

On the flip side, inflation also erodes the value of future cash.

Here's an extreme instance. Venezuela in May 2021 had inflation rise 28.5% in a single month with the annual inflation coming in at 2,719%.

This means that something that costs $1 would cost $27.19 in a year. Something that's $1,000 would cost $27,190 in a year.

In a single year, they lost 96% of their purchasing power.

Can you imagine being charged $90 for a cup of coffee that cost $3 last year?

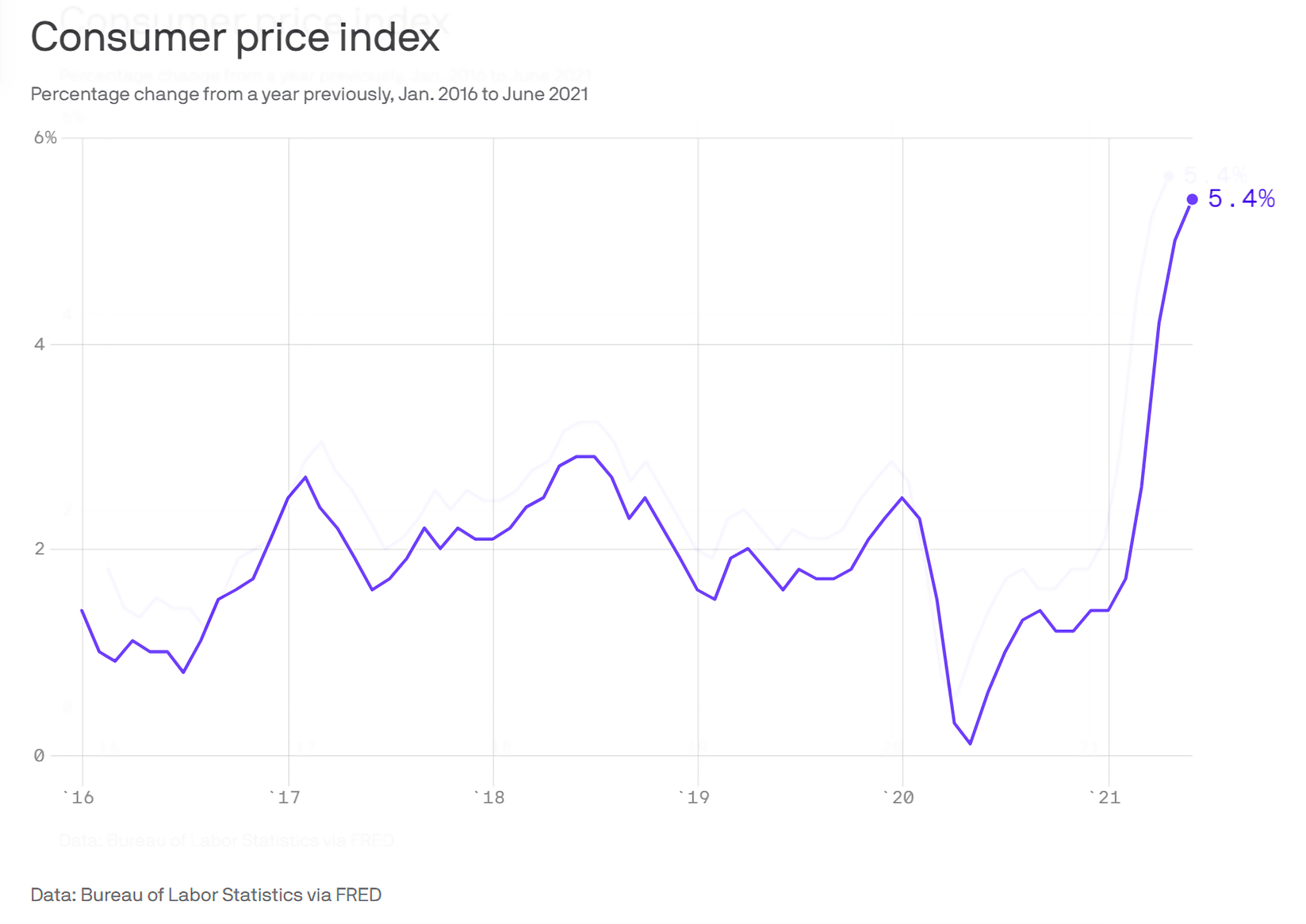

However, for most other economies, the inflation rate tends to be much more stable and far less intrusive. Inflation in the US reached 13.5% annually back in the 1970s, but inflation has hovered around 1-3% over the last decade.

2021 is the exception with prices jumping almost 5% annually (in case you've noticed prices get more expensive everywhere).

What this means is that if you're making the same salary as you did last year, you've actually lost ~5% of your purchasing power.

The value of our dollars and correspondingly, our salaries, fell by doing nothing.

That's why it's so important to have annual raises that at least match inflation otherwise it's an incredibly deceptive way workers get hurt.

Inflation is also why comparisons over long time periods should always be inflation-adjusted.

Let's look at the price of eggs.

In 1980, a dozen eggs cost $0.84, almost half as expensive as the average cost of a dozen eggs now at $1.51 in 2020.

When we adjust for inflation, we see that eggs actually cost $2.02 in today's dollars per dozen! It took more purchasing power back to buy the same carton of eggs.

Remember that today's dollars are worth less than past dollars. This is usually unnoticeable over shorter periods, but can really make a difference over longer periods.

The same story plays out for cars.

When Ford's basic Model T came out in 1909, it cost $850, far cheaper than the cost of a brand new car today where even a low-end model may cost $15,000.

However, as we've seen, inflation makes past prices deceptive. After more than a century, when we adjust for inflation, that Model T costs $25,000 in 2021 dollars.

This means cars are not only worth relatively less now than back then, but they are also significantly safer, higher quality, and technologically advanced. Great bang for our buck!

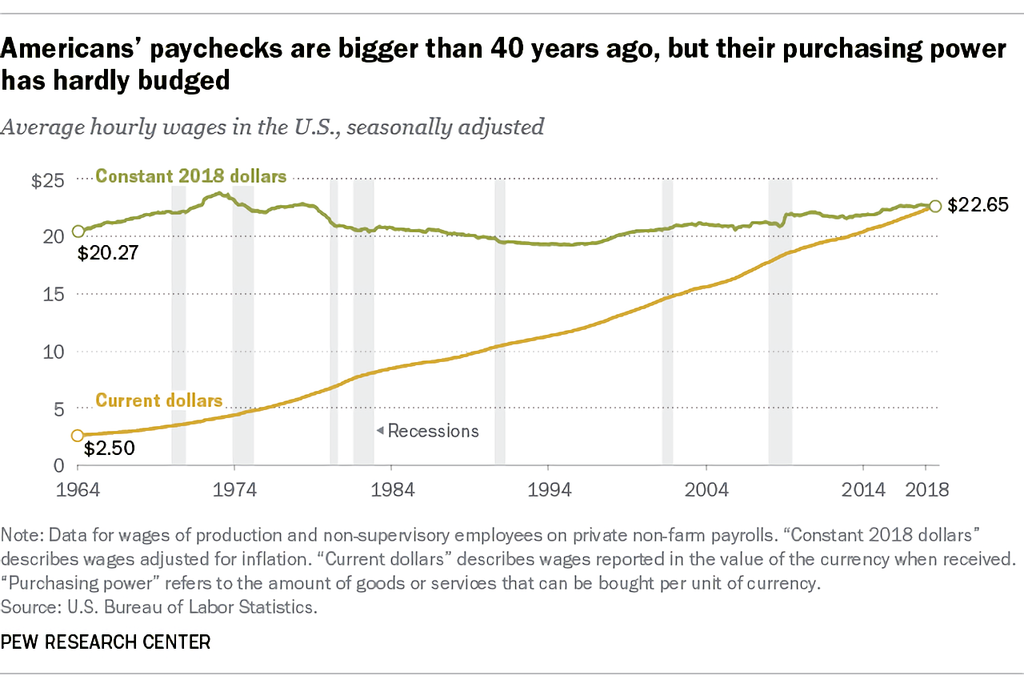

On the flip side, if we look at salaries, in 1964 the average hourly wage was $2.50, while by 2018, it was $22.65.

That's about a 900% increase over the decades! The logical train of thought is that we must be capable of affording so much more now.

However, as we've seen, inflation changes the story dramatically. If we adjust salaries to 2018 dollars, we see that wages have actually stayed flat since 1978.

Objectively, this isn't terrible since we're able to purchase the same amount of goods or services as we used to, but if we dig into the data a bit we see a different story.

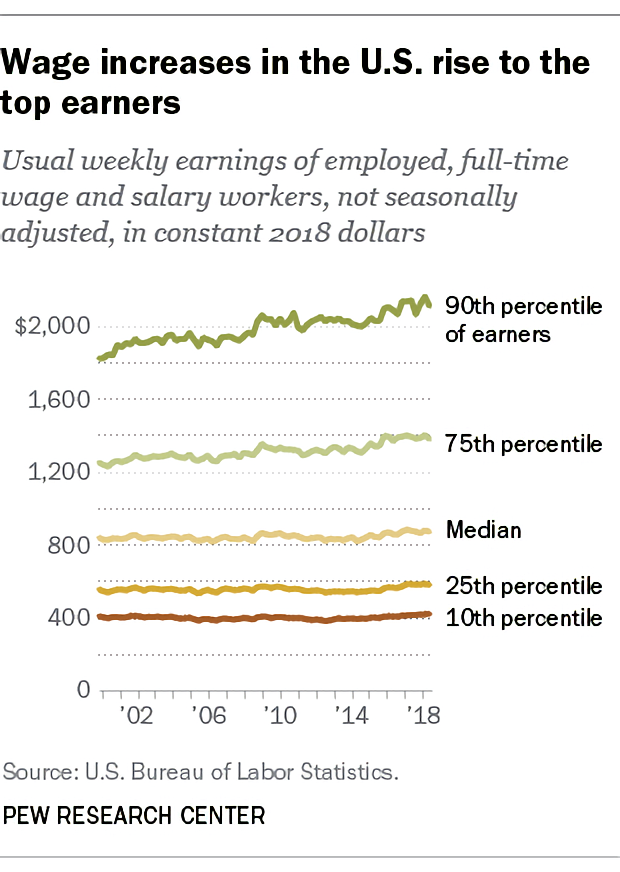

Any of the gains, even after adjusting for inflation, have overwhelming gone to high earners, which means that the quality of life for the average American has stayed the same, while high-income earners have not only always enjoyed better lifestyles but are now able to afford even more.

Though this massive income gap probably doesn't come as a surprise to most.

The people who are hurt the most are minimum wage workers with the federal minimum wage at $7.25 an hour last raised in 2009.

For a worker still being paid the federal minimum wage now to have the same purchasing power as a decade ago, they would need to be making $9.15 once we factor in inflation.

You can check yourself by going to this inflation calculator and plugging in $7.25 for 2009 and checking for buying power in June 2021.

If minimum wage workers are still being paid the same amount now as they were a decade ago, they've actually lost about 25% of their purchasing power!

So if your income has remained the same over a few years and you feel like it's getting harder to maintain a lifestyle or make ends meet, you're probably right.

Inflation steadily erodes our actual purchasing power, making cash on hand today that much more valuable since we can put it to work.

This means that to protect and grow our wealth we should be invested in wealth appreciating assets like stocks, cryptos, or real estate.

It's all about making your money work for you.

For most of us, that cash on hand today comes in the form of our salaries or hourly wages, which are our expected income that generates this investable money.

If it's not raised to at least match inflation every year, our ability to accrue that future wealth from our job drops every single year.

Hence, the time value of money.

There are rigorous, mathematical formulas for modeling the time value of money, which I won't get into here, but take a look if you're interested in calculating precise values of investment opportunities.