Your Credit Journey: A Simple Guide to Building Strong Credit

An explainer series to understanding and improving your credit

Building a strong credit score is essential for financial health. Here's an explainer series to understanding and improving your credit:

- Understanding My Credit Journey So Far: Learn about my experiences and lessons from navigating the world of credit.

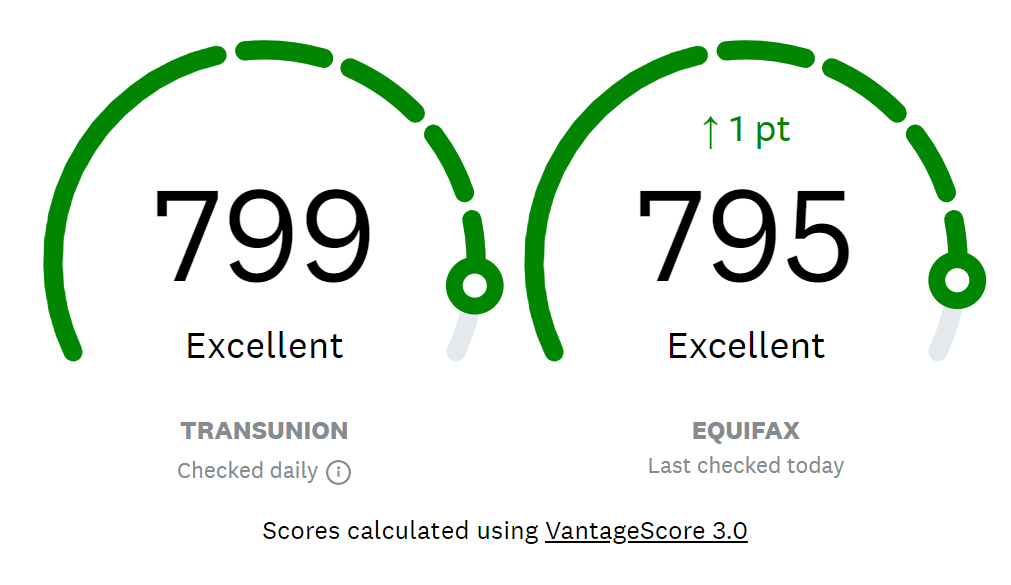

- What Are Credit Scores? A Brief Intro: Your credit score reflects your creditworthiness, influencing loan approvals and interest rates. Scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

- Why Care About Credit Scores?: A good credit score can save you money through lower interest rates and better financial products. It's also a key factor in employment and housing decisions.

- The Importance of Payment History: Payment history is the most significant factor in your credit score. Consistently paying debts on time builds trust with lenders and boosts your score.

- Length of Credit History: The longer your credit accounts have been active, the better. Opening your first account early can help establish a solid credit history.

- Min-Maxing Credit History: Dive into strategies for optimizing your credit history to maximize its impact on your score.

- Understanding Credit Utilization: Keep your credit card balances low relative to your credit limits. Aim to use less than 30% of your available credit to positively impact your score.

- Limit Testing with Credit Limits: Personal experiences with pushing my credit limit to over 200k and some exposition.

- Credit Scores: All the Rest: Explore additional factors like account mix and new credit applications that influence your score. Balancing these responsibly can lead to a healthier credit profile.

By focusing on these areas, you can build and maintain a strong credit profile, opening doors to better financial opportunities. Dive into each post to get the full details and take control of your financial future!

If you prefer a long-form format instead, look no further than here:

Your Credit Score, Explained.

Credit scores are a single number that attempts to represent how responsible you are as a borrower. Think of it the same way we use Amazon ratings to determine what product to buy or how we use Google ratings to determine where to eat.